I recently had the pleasure to participate in a webinar with the TM Forum, the premier standards body for the global B2B telecommunications industry, and MongoDB, based on the publication of one of TM Forum’s key industry reports, entitled Cutting Complexity With Automation And AI.

This marks the seventh edition of this report, spanning a five-year period of surveying the industry on digital transformation. During this time, TM Forum have polled the industry with the same questions, while also focusing on specific items within each report – thus also charting an evolution in CSP and vendor views on digital transformation. There are also interesting sections on Closed-Loop Network Automation and the use of Artificial Intelligence (AI) in telecommunications.

The full report can be found HERE, and a link to the webinar can be found HERE.

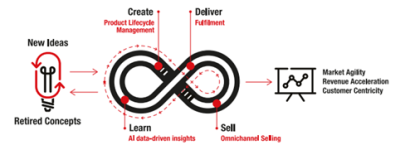

In a Hansen article within the report, we present our position on how the use of what we call an ’agile commercial layer’ can help operators improve their transformation success with a solution that aligns to the TM Forum Open Digital Architecture. This solution directly addresses some of the challenges for CSPs that are listed in the report and delivers the benefits they are seeking. One of our diagrams illustrating that layer is shown below:

In my view, the report shows that the need and the drivers for products, that we at Hansen specialise in (such as managing complex billing and enabling the agility to quickly create new offerings), are still strong in the industry and deliver the outcomes that the CSP of today needs to succeed.

Here are some of my takes on the content of the report:

It is apparent that COVID-19 drove a lot of digitalisation efforts. To quote the CEO of Telefonica: “During the initial [COVID] confinement, digitalisation advanced as much as it would have done in five years. For, every month of confinement, we made a year’s progress in digitisation.” This is likely the reason that, starting in 2023, it would appear that the pace of transformation decreased from 2022 onwards. But I think the report shows that digital transformation projects continue across the industry.

And the need for transformation does seem to be there. The macroeconomics of the industry aren’t great as operators struggle to monetise 5G and many listed in the report have initiated significant layoffs.

And more may be coming. Transformation means not only modernisation, but also automation – and the resulting efficiencies will reduce the need for staff. The expectation is that the arrival of AI will expedite this expected trend in reduction.

But ironically, CSPs are also struggling to hire. The influx of new technologies and concepts – cloud native, DevSecOps, etc. – need a new type of employee; one who can span both telecommunications and next-generation IT knowledge. To quote BT’s Chief Networks Officer: “I think we’ve got to create a new model – we call them ‘netware’ people. They’ve got to have brilliant network skills and brilliant software skills.”

People with that new way of thinking are hard to find, and in demand across the IT world as well.

Despite all that gloom, the survey shows CSPs to be optimistic about their ability to transform and succeed. The CTIO of Telefonica says: “I [have been] in this industry since the 1980s. This is the first time, to be honest, that I see that we have a common view; we have a common concern.” CSPs seem united in the goal of evolving to become a platform operator – emphasising standards and commonality. They want a better business model where they provide the marketplace, combining partner products and their network capabilities into new and innovative offerings.

But they still suffer barriers getting to that goal. Surprisingly, a lack of vision and the need for culture change are seen as the highest barriers. But complexity of product portfolio and processes, along with inflexible legacy IT technology, still rank high. These are issues that we can directly address with our products and solutions.

There are interesting sections on:

- Intent-based automation, including closed-loop management. This topic is likely worth a blog post all on its own.

- AI and Machine Learning (ML) – Again, a topic worth its own blog post. While there is clearly a focus on AI in network operations, there are also some other good examples on where CSPs can, and are, using AI. But many operators are cautious in implementing AI. And the foundation of good AI and ML is good data – something our systems at Hansen can readily deliver.

Also included in this report is a shout-out to the Zero Touch Digital Marketplace Catalyst project where our products play a key role in ‘powering’ a CSP marketplace. We will be showcasing this at the Digital Transformation World conference in Copenhagen, come September.

What both the TM Forum report and the webinar spotlight, in detail, are the pressing questions that will come up as we make more strides into the AI, IoT, 5G and Big Data era. It may not answer every question (of course), but it does provide something of a good starting point and one that both business and technology leaders should look to explore in further detail – sooner rather than later.

Be sure to check out the full report and watch the webinar.