July 14, 2025 – Hansen Technologies Limited (ASX: HSN), a leading provider of industry-specific software products to the energy & utilities and communications & media industries, announces an upward revision to its FY25 Underlying & Cash EBITDA guidance.

Guidance Update – Improved Profitability

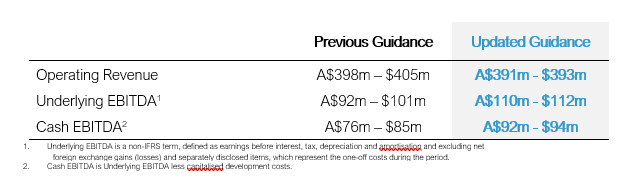

Hansen is pleased to announce an upward revision to its FY25 Underlying & Cash EBITDA guidance, driven by improved operating efficiencies, disciplined cost management, and a positive earnings contribution from powercloud, which returned to profitability ahead of expectations at the time of acquisition. The FY25 Underlying EBITDA margin is now anticipated to be approximately 28% and the FY25 Cash EBITDA Margin is expected to be approximately 24%. Underlying EBITDA and Cash EBITDA are now expected to be respectively 19-21% and 20-22% higher in FY25 compared with FY24.

Industry tailwinds from both Hansen verticals are driving increased demand for the Group’s products and services globally. However, due to project timing and customer-driven factors, some revenue will shift to FY26, resulting in a modest adjustment to the previous revenue guidance as outlined below. Notwithstanding this adjustment, FY25 is still expected to deliver solid operating revenue growth of approximately 11% compared with FY24, and growth of approximately 5% excluding the impact of the powercloud acquisition. The Company has a solid pipeline of committed business and remains optimistic about its growth potential beyond FY25.

Customer Update

Hansen is also pleased to provide an overview of recent customer wins including:

- A four-year agreement with Vattenfall to implement the Hansen CIS in Finland for a TCV of $5.5m.

- An agreement with a Nordic B2B energy retailer Å Entelios to deploy Hansen CIS in support of its expansion into the Danish market.

- A transformative $50m five-year agreement with VMO2, a JV between Telefónica and Liberty Global, announced to the market on 3 February 2025.

- A strategic five-year agreement with one of the largest renewable energy portfolios in the US, for an estimated contract value of $16m.

- Multiple new agreements with a combined TCV of over $5m and increasing annual recurring revenue by $1.4m for various modules of the automated Hansen Trade platform. New customers include Aneo, Modity, World Kinect and Å Entelios. Regions include Finland, Sweden and Hansen’s first ever deployments of Hansen Trade into Norway, Denmark and The Netherlands.

This announcement is authorised by the Board.