August 24th, 2022 – Hansen Technologies Limited (ASX: HSN) (“Hansen”, the “Company”), a growing aggregator of mature, entrenched and predictable providers of software to the Energy, Water and Communications sectors, is proud to share its FY22 results including a record dividend for the full year.

While navigating a combination of global challenges, Hansen’s disciplined approach of providing modular software that delivers business-critical solutions to its customers around the world has generated a strong financial outcome for the year.

The company’s strategy of building out the Hansen Suite into modular software with cloud-native and SaaS-based options is proving core to the ongoing strength of Hansen’s overall performance. Highly predictable revenues are helping afford strong business resilience in times when many in the technology sector are struggling.

Throughout FY22 Hansen continued to grow organically, while progressing transformative projects for strategic customers including DISH, Fortum and Vattenfall and completed its major software delivery for Telefonica. This latter project is scheduled to go live before the end of the calendar year. When considering Hansen’s year-on-year performance, it is important to recall the prepaid licence received from Telefonica that generated $21m of revenue and profit within the FY21 year.

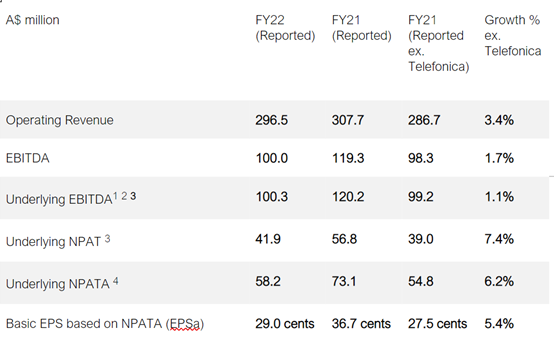

The following table demonstrates the growth across all the major financial metrics after adjusting for Telefonica.

[1]The Directors believe the information additional to IFRS measures included in the press release is relevant and useful in measuring the financial performance of the Group. These include: EBITDA, NPATA and EPSa.

[2] EBITDA is a non-IFRS term, defined as earnings before interest, tax, depreciation and amortisation and excluding net foreign exchange gains (losses).

[3] Underlying EBITDA, underlying NPAT and underlying NPATA exclude separately disclosed items, which represent the one-off costs and income during the period. Further details of the separately disclosed items are outlined in Note 4 to the Financial Report which can be found on the Company’s website.

[4] NPATA is a non-IFRS term, defined as net profit after tax, excluding tax-effected amortisation of acquired intangibles.

Note: This ASX announcement should be read in conjunction with the Annual Report which can be found on the Company’s website.

RESULTS SUMMARY

Hansen’s Chief Executive Officer, Andrew Hansen, said: “Despite all the headwinds of the past 12 months, I am incredibly proud that Hansen continues to build on its more than 50 years of sustainable, profitable and cash-generative growth.”

“The FY22 result reinforces the long-term resilience of our business – a business where we consistently put our customers and our people at our heart to deliver mission-critical software solutions to the essential sectors of society.”

Revenue

Operating revenue for FY22 was $A296.5m, up 3.4% on FY21 after adjusting for the one-off Telefonica licence recognised last year.

“It is very pleasing that our existing customers continue to upgrade to the latest versions of Hansen products and support us with recommendations that deliver new customers into the Hansen fold.”

In the past 12 months, Hansen has experienced strong renewals, the continued adoption of new products by existing customers, as well as the addition of new logos like Exelon (the largest utility company in North America) to the Hansen customer base.

EBITDA

Underlying EBITDA for FY22 was $A100.3m up 1.1% on FY21 after adjusting for the one-off Telefonica licence recognised last year.

The FY22 underlying EBITDA margin remained strong despite cost pressure on the labour front and the slow return of some travel and occupancy related costs as the world opened once again.

Hansen’s program of cost control through efficiency programs has assisted to reduce the impact these increases have had on profit and shareholder return.

Cash flow and debt

Hansen has completed another year with free cash flow exceeding $A63m. This strong free cash flow generation is after paying tax and investing $A15.6m in product development.

We have used this free cash flow to:

- Reduce borrowings by $A34.0m.

- Fund cash dividends of $A22.4m.

- Build cash reserves by a further $A7.3m to $A59.6m.

This strong conversion of profit to cash demonstrates Hansen’s resilience and provides confidence to our customers that we will continue to grow and support their needs as the global economy adjusts to the economic changes occurring across the world.

Update on aggregation strategy

Hansen’s aggregation strategy continues as we look to grow strategically in our existing markets and expand into other markets where our professional experience can be leveraged. With more opportunities coming to market our dedicated M+A Team is busy assessing those that have the potential to deploy Hansen’s capital to generate the best possible outcome for shareholders.

Hansen’s strong Balance Sheet and proven track record of earnings accretive acquisitions sees it well supported by a banking consortium that is committed to provide funds for this strategy.

Dividend

Considering Hansen’s consistent performance throughout the 2022 Financial Year, the Board has declared a final, partially franked, dividend of 5.0 cents per share. The record date for the final dividend is 30 August 2022 and the payment date is 21 September 2022. The Dividend Reinvestment Plan (DRP) will again be available to shareholders with no discount. The DRP election cut-off date will be 31 August 2021.

This consistent financial outcome has enabled us to declare dividends amounting to 12.0 cents per share this year returning 41% of NPATA to shareholders.

Outlook

The Hansen Management Team remains focussed on the company’s growth ambitions while continuing to deliver to the strong global customer base that the business has today.

“We are confident in our people, in the strength of our growing talent pool spread across the world, and in the investment that we have made in our Global Sales and M+A teams, which combined will see continued organic and inorganic growth delivered to our shareholders over time.”

About Hansen Technologies

Hansen Technologies (ASX: HSN) is a leading global provider of software and services to the energy, water and communications industries. With its award-winning software portfolio, Hansen serves 600+ customers in over 80 countries, helping them to create, sell, and deliver new products and services, manage and analyse customer data, and control critical revenue management and customer support processes.

For more information, visit www.hansencx.com