February 18, 2026 – Hansen Technologies Limited (ASX: HSN) (‘Hansen’, the ‘Company’, the ‘Group’), a global leader in industry-specific software, today announced its results for the half-year ended 31 December 2025 (1H26), delivering a strong financial performance driven by continued revenue growth, expanding margins, increasing operational efficiency and strong growth in operating cash. The Group’s resilient recurring revenue base, disciplined execution, and progress in key strategic initiatives, including the acquisition of Digitalk, position Hansen for increased revenue in 2H26 vs 1H26.

1H26 Highlights

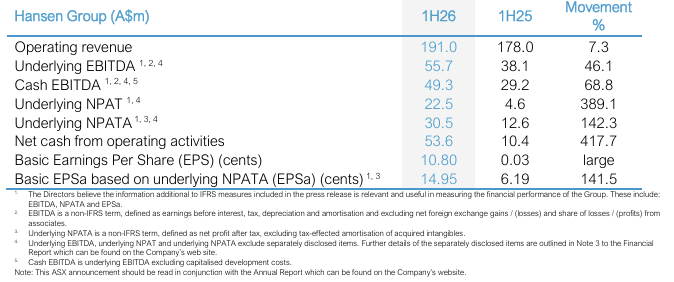

- Operating revenue of $191.0 million, up 7.3% on 1H25.

- Underlying EBITDA up 46.1% to $55.7 million, reflecting improved operating leverage.

- Cash EBITDA up 68.8% to $49.3 million, from cost discipline.

- Support & Maintenance revenue up 15.6% from 1H25, driven by low churn, multi-year renewals, and a broad mission-critical installed base.

- Underlying NPATA up 142.3%, and Underlying NPAT rose 389.1% from 1H25, supported by strong operating leverage, tighter cost control, and ongoing efficiency gains across the business.

- Net cash from operating activities increased 417.7% to $53.6 million.

Results Summary

Hansen’s Global Chief Executive Officer and Managing Director, Andrew Hansen, said:

“Our strong first-half results highlight the resilience of our business model and the dedication of our teams around the world. The successful integration of acquisitions, our continued innovation, and our unrelenting focus on customer outcomes have set Hansen up to capture new opportunities globally. I want to sincerely thank all Hansen people for their commitment and collaboration, together we are building a stronger, more innovative Hansen for the future.”

Segment Performance

Communications & Media

The Communications & Media segment delivered 13.5% revenue growth, supported by major new wins and multi-year renewals with Tier-1 operators, including MultiChoice. The increasing adoption of Hansen’s cloud-native, modular BSS platforms continues to improve customer agility and reduce total cost of ownership. The Group also received industry recognition, winning Fast Mode’s “Digital BSS Trailblazer Award” for innovation in 5G monetisation and digital transformation.

Energy & Utilities

Energy & Utilities revenue increased 3.0% on 1H25, driven by a strong contribution from EMEA and continued industry investment in smart-metering, renewable integration, and digital infrastructure. Hansen secured new customers and renewals including City of New Bern and Charlotte County Utilities in the US., and Loiste and Elkraft in the Nordics. The successful turnaround of powercloud (Hansen Germany) and ongoing enhancements across metering and market-operations platforms further strengthened Hansen’s competitive position.

Cash Flow and Capital Management

The Group delivered strong cash generation during the half, with operating cash flow of $53.6 million, an increase of 417.7% on 1H25. Capitalised development costs were tightly managed, supported by operating leverage achieved through AI and efficient utilisation of our global workforce. Despite the increased borrowings associated with the Digitalk acquisition, the Group repaid a further $29.5 million of existing debt during the period and had Net Debt of $51 million at the end of 1H26.

Hansen and Artificial Intelligence

Artificial Intelligence (AI) continues to reinforce Hansen’s long-term investment case. Hansen operates as the system of record at the core of customer operations, the authoritative source of truth for billing, settlement and revenue.

Hansen is embedding AI as a core capability across its people, platforms and products, integrating it directly into the core system rather than treating it as an overlay. The Company’s approach prioritises responsible, compliant, and explainable AI, reflecting the highly regulated and mission-critical nature of the energy and telecommunications markets in which it operates.

Hansen is structurally protected from near-term AI disruption due to its deep incumbency and subject matter expertise within complex, regulated customer environments. One of Hansen’s key advantages is the depth and longevity of the data it holds across customers and the markets they operate in. This is proprietary data that generic AI cannot access. The Company operates at the core of large, complex energy and telecommunications systems supporting billing, revenue, customer acquisition and compliance functions that are critical to customer operations and cash flow. Extensive regulatory integrations, decades of industry-specific data and workflows, and high trust requirements create substantial barriers to entry and make switching multi-year and high-risk.

AI is being used to strengthen, rather than disrupt, Hansen’s competitive position. By embedding AI into core billing, customer care, analytics and workflow capabilities, Hansen is improving platform efficiency, accelerating implementations, lowering cost-to-serve and deepening customer integration. These enhancements further increase switching costs and widen the gap between Hansen and smaller or less specialised competitors.

Execution is underway and delivering tangible outcomes. Hansen has established AI Hubs in California and London and built a champion network driving adoption across the organisation. Eight AI solutions are embedded within the platform and delivering measurable customer outcomes.

Outlook

Hansen expects revenue to be higher in 2H26 vs 1H26 and remains on track to deliver an Underlying EBITDA margin of around 30% for FY26. The Board continues to target 5-7% organic revenue growth over the medium term. Sector tailwinds, including smart-grid upgrades, decarbonisation, digitalisation, 5G expansion, and AI-enabled operations; continue to expand Hansen’s global addressable market.

With a strong recurring revenue base, disciplined execution, a deep AI defensive moat and scalable platforms across two essential service industries, Hansen is well positioned to deliver sustainable growth and long-term shareholder value.

Medium-term strategic priorities include:

- Further investment in AI and R&D to drive product enhancements and operational efficiencies.

- Accelerating growth across Hansen’s global footprint.

- Realising the benefits of the Digitalk acquisition in 2H26 and beyond.

- Continuing to assess targeted M&A opportunities.

- Delivering long-term value through operational resilience, technology leadership, and a deep understanding of clients’ evolving needs.

Dividend

The Board has declared an interim dividend of 5.0 cents per share, partially franked to 4.0 cents per share. The record date for the interim dividend is 24 February 2026 and the payment date is 27 March 2026. The Dividend Reinvestment Plan (DRP) will again be available to shareholders with no discount. The DRP election cut-off date will be 25 February 2026.

Investor and Analyst Briefing

An investor and analyst briefing will be held to discuss the 1H26 results.

- Date: 18 February 2026

- Time: 10:00am Melbourne time

- Format: Webcast

- Register here to receive a calendar invite and reminder

We encourage investors and analysts to register in advance to ensure timely access to the briefing.

For further information: Investor and analyst enquiries

- Peter Beamsley. Head of Investor Relations

- +61 438 799 631 or Investor.Relations@hansencx.com

Important information

This announcement contains forward-looking statements that involve subjective judgement and analysis and are subject to significant uncertainties, risks and contingencies, many of which are outside the control of, and are unknown to the Company. These forward-looking statements use words such as ‘potential’, ‘expect’, ‘anticipate’, ‘intend’, ‘plan’, ‘target’ and ‘may’, and other words of similar meaning. No representation, warranty or assurance (express or implied) is given or made in relation to any forward-looking statement by any person (including the Company). Actual future events may vary materially from the forward-looking statements and the assumptions on which the forward-looking statements are based. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Subject to the Company’s continuous disclosure obligations at law and under the listing rules of the Australian Securities Exchange, the Company disclaims any obligation to update or revise any forward-looking statements. The factors that may affect the Company’s future performance include, among others: changes in economic conditions; changes in the legal and regulatory regimes in which the Company operates; litigation or government investigations; competitive developments affecting our products; changes in behaviour of major customers, suppliers and competitors; acquisitions and divestitures; the success of research and development activities and the Company’s ability to protect its intellectual property.