August 20, 2025 – Hansen Technologies Limited (ASX: HSN) (‘Hansen’, the ‘Company’, the ‘Group’), a leading provider of industry-specific software products and expertise, today announced its results for the financial year ended 30 June 2025 (FY25). Amid a dynamic operating environment, Hansen demonstrated strong financial discipline, strong earnings growth, and continued global progress across its strategic priorities.

The year also reinforced the stability and defensive nature of the two verticals Hansen serves: Energy & Utilities and Communications & Media. These sectors are undergoing generational transformation, driven by structural shifts such as decarbonisation, digitalisation, the electrification of infrastructure, and the global rollout of 5G. These changes continue to drive demand for scalable, mission-critical platforms like those provided by Hansen. The Group is well positioned to capture value from these tailwinds through its global delivery model, recurring-revenue base, and targeted investments.

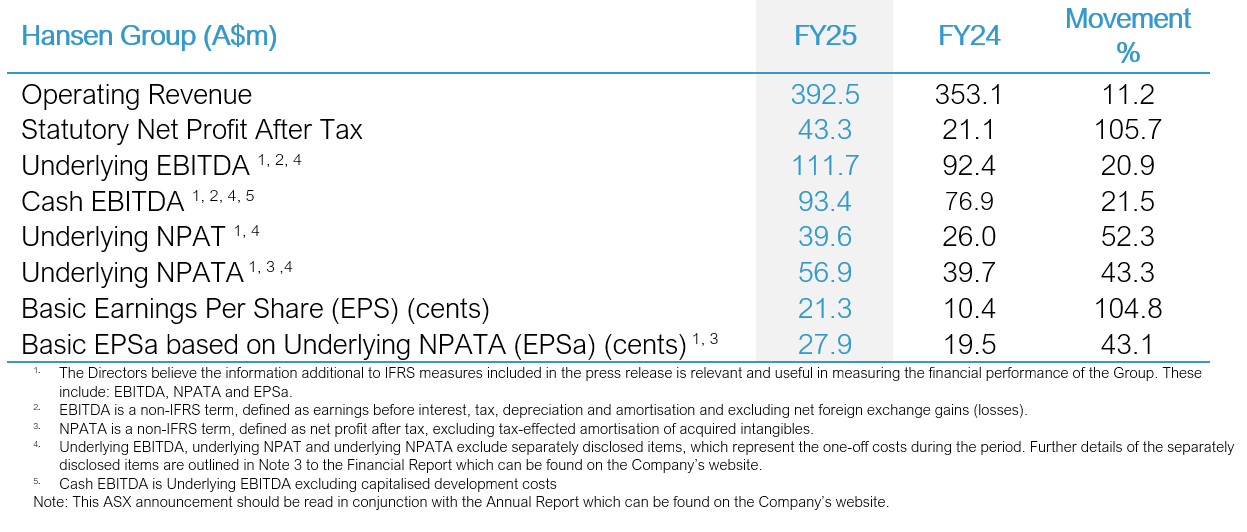

The Group reported full-year revenue growth of 11.2%, supported by the full-year contribution of powercloud and expanded customer activity in the Communications & Media sector. Underlying EBITDA grew 20.9%, while Cash EBITDA increased 21.5%. This strong performance was underpinned by improved operating efficiencies and disciplined cost management, alongside several key customer upgrades and notable new logo wins.

Results Summary

Hansen’s Global Chief Executive Officer and Managing Director, Andrew Hansen, said:

“FY25 was a year where our stability and resilience truly shone through. Despite some customer-driven project delays and economic uncertainty in several markets, Hansen stayed firmly on course. We delivered strong earnings, reduced debt, continued significant investment in our products, and built even stronger foundations for long-term growth.”

“Our transformation efforts at powercloud are delivering real benefits. We’ve streamlined operations, reduced costs by over $31m, and enhanced alignment with Hansen’s global platform. At the same time, Hansen signed a significant A$50m deal with VMO2, launched new AI capabilities in our products and made further strategic investments, all while expanding our footprint across Europe and North America.”

“This year’s performance reflects our team’s commitment to client success, innovation, and sound financial management. We’re entering FY26 with momentum and clarity, underpinned by strong recurring revenues and deep engagement across two essential global sectors.”

Revenue

Hansen reported Operating revenue of $392.5m in FY25, representing year-on-year growth of 11.2%. While some projects experienced timing-related delays in the first half, revenue momentum accelerated in 2H25.

The Communications & Media vertical delivered revenue growth of 15.0% to $171.3m. Demand for digital transformation and modernisation of legacy systems continues to grow as communication providers seek to replace ageing, monolithic systems with modular platforms that can reduce time to market, lower cost-to-serve, and improve customer engagement. The global rollout of 5G, the growth of connected devices, and increasing customer expectations continue to create favourable market conditions for Hansen’s offerings.

The Energy & Utilities vertical reported revenue growth of 8.3% to $221.2m, including the contribution from powercloud. This sector remains highly resilient, with demand fueled by long-term structural trends such as the global shift to renewable energy, the rollout of smart meters, and increasing regulatory complexity. These dynamics are prompting utility providers to modernise and digitise their operations, creating strong tailwinds for Hansen’s scalable and cloud-ready platforms.

Hansen is pleased to provide an overview of recent customer wins and new agreements including:

- A four-year agreement with Vattenfall to implement the Hansen CIS in Finland for a total contract value of $5.5m.

- An agreement with a Nordic B2B energy retailer Å Entelios to deploy Hansen CIS in support of its expansion into the Danish market.

- A transformative $50m five-year agreement with VMO2, a JV between Telefónica and Liberty Global, announced to the market on 3 February 2025.

- A strategic five-year agreement with one of the largest renewable energy portfolios in the US, for an estimated contract value of $16m.

- Multiple new agreements with a combined TCV of over $5m, increasing annual recurring revenue by $1.4m for various modules of the automated Hansen Trade platform. New customers include Aneo, Modity, World Kinect, and Å Entelios. Regions include Finland, Sweden and Hansen’s first-ever deployments of Hansen Trade into Norway, Denmark and The Netherlands.

Underlying & Cash EBITDA

Underlying EBITDA and Cash EBITDA both exceeded the initial guidance provided in August 2024. Underlying EBITDA grew 20.9% to $111.7m, with a robust Underlying EBITDA margin of 28.5%, while Cash EBITDA increased 21.5% to $93.4m, with a Cash EBITDA margin of 23.8%. Earnings were temporarily impacted in the first half by lower licence fee recognition and targeted investment in growth capacity and operational efficiency. The second half of the year delivered a significant uplift as major customer agreements commenced and deferred project milestones were delivered, coupled with careful cost containment.

The foreign exchange impact for FY25 on operational activities was immaterial. Hansen operates with a broad mix of currencies and primarily incurs costs in the same countries where it generates revenue.

Cash Flow and Net Cash

Free Cash Flow was solid at $30.4m, underpinned by improved licence revenue and disciplined working capital management. Operating cash flow of $72.6m supported further reinvestment in innovation, repayment of acquisition-related debt, and delivering shareholder returns. The Group’s cash conversion ratio[1] was stable at 0.7x (FY24: 0.7x), and the second half was particularly strong.

Net debt was reduced to $17.4m by 30 June 2025, down from $24.5m at the end of FY24. This reduction reflects prudent capital allocation and strong operational cash flows, offset by the strategic investments in Dial AI and the CONUTI software assets. Hansen’s leverage ratio[2] remains low at 0.2x, positioning the Group well for future M&A opportunities. Reflecting continued strong cash generation into FY26 the Company was net cash positive at the date of this release.

Innovation and M&A

Innovation remains a core pillar of Hansen’s strategy. In FY25 approximately $34.5m was invested in R&D, with $18.3m capitalised and $16.2m expensed on continuous enhancements and operational improvements. Investment was directed toward cloud-native billing platforms, AI-powered engagement tools, and modular market-specific upgrades. Hansen’s global delivery centres in India, Vietnam, and Argentina enabled rapid development cycles, cost efficiency, and client-aligned outcomes.

In addition to ongoing transformation efforts at powercloud, Hansen strengthened its presence in Europe through the acquisition of strategic CONUTI software assets in Germany and undertook a strategic investment in Dial AI based in North America. These moves are aligned with Hansen’s broader strategy to scale in key markets and deepen product capability across mission-critical customer platforms.

This year, Hansen achieved a positive impact from its investment in AI, which is now helping the business operate more efficiently, automate routine tasks, and enhance customer service. From software testing and customer support to product innovation, AI capabilities are increasingly embedded across the organisation. While still in the early stages, AI is clearly emerging as a key driver of productivity, customer experience, and long-term value creation for Hansen.

Hansen maintains a strong M&A pipeline, targeting high-growth markets and scalable product opportunities in Energy & Utilities and Communications & Media, while exploring select adjacent sectors with strong strategic fit.

We focus on mission-critical software with clear IP ownership, recurring revenues, Tier 1 and Tier 2 customer relationships, and opportunities to leverage our commercial and technical expertise to drive long-term growth and value.

Sustainability

The Group’s sustainability performance also advanced materially in FY25. Hansen maintained carbon neutrality for its Australian operations for a fourth consecutive year and has achieved a 40% reduction in Australian emissions since FY22, exceeding its initial reduction target by two years. The Group was recognised with the EcoVadis “Committed” badge and received an AA ESG rating from MSCI, reinforcing its leadership position in sustainability among global technology providers.

Dividend

The Board has declared a second half dividend of 5.0 cents per share, partially franked to 2.5 cents per share. The record date for the final dividend is 26 August 2025 and the payment date is 19 September 2025. The Dividend Reinvestment Plan (DRP) will again be available to shareholders with no discount. The DRP election cut-off date will be 27 August 2025.

Outlook

Hansen enters FY26 with a strong foundation of resilient and recurring revenue, low leverage, and an expanding global customer base.

The structural transformations taking place in both the Energy & Utilities and Communications & Media sectors continue to drive tailwinds for the business, with increasing regulatory demands, infrastructure modernisation, digital engagement, and decentralised energy systems all supporting long-term growth.

Strategic priorities include investing further in AI and R&D to drive product enhancements and operational efficiencies, executing high-quality project delivery, accelerating growth across Hansen’s global footprint, and continuing to assess targeted M&A opportunities. The Group remains committed to delivering long-term value through operational resilience, technology leadership, and a deep understanding of its clients’ evolving needs.

Hansen continues to target organic revenue growth of 5–7% over the medium-term, supported by sector tailwinds and ongoing product innovation, noting that FY25 had a higher proportion of licence revenue than is expected in FY26. We continue to target a medium-term Underlying EBITDA margin of 30% or above through disciplined cost management and operational efficiency.

NOTES

Important information

This announcement contains forward-looking statements that involve subjective judgement and analysis and are subject to significant uncertainties, risks and contingencies, many of which are outside the control of, and are unknown to the Company. These forward-looking statements use words such as ‘potential’, ‘expect’, ‘anticipate’, ‘intend’, ‘plan’, ‘target’ and ‘may’, and other words of similar meaning. No representation, warranty or assurance (express or implied) is given or made in relation to any forward-looking statement by any person (including the Company). Actual future events may vary materially from the forward-looking statements and the assumptions on which the forward-looking statements are based. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Subject to the Company’s continuous disclosure obligations at law and under the listing rules of the Australian Securities Exchange, the Company disclaims any obligation to update or revise any forward-looking statements. The factors that may affect the Company’s future performance include, among others: changes in economic conditions; changes in the legal and regulatory regimes in which the Company operates; litigation or government investigations; competitive developments affecting our products; changes in behaviour of major customers, suppliers and competitors; acquisitions and divestitures; the success of research and development activities and the Company’s ability to protect its intellectual property.

- Cash Conversion Ratio is EBITDA divided by Net cash from operating activities.

- Leverage Ratio is Net Debt (Cash Assets less Interest-Bearing Liabilities) divided by Underlying EBITDA. Underlying EBITDA is a non-IFRS term, defined as earnings before interest, tax, depreciation and amortisation and excluding net foreign exchange gains (losses) and separately disclosed items, which represent the one-off costs during the period.